Those who wish to become CPAs in Georgia must have a bachelor's degree and work experience. However, the educational requirements for Georgia CPA licensure are not as stringent as those in other states.

Candidates must be at the least 18 years old, and they must have a Social Security number. They also must have a bachelor's degree from an accredited college or university. Candidates who have studied at an American college must have their academic credentials evaluated and certified by NASBA International Evaluation Services. The state board must also approve their academic credentials.

Applicants must also achieve a minimum score equal to 75 on CPA exam. The NASBA website has more information. The amount of public accounting work the candidate has must be equal to the score. The candidate must have had work experience within one year of submitting their application. Under the supervision of a licensed CPA, the applicant must have gained his or her work experience. The candidate need not report to a licensed CPA if their work experience is in government or academia. Candidates in academia and government will however have their work experience supervised by their supervisors.

Georgia CPAs who are interested in becoming certified must have 120 semesters of college credit. Of these, at least 24 must be in business courses. Candidates must also have 30 semesters in accounting courses. Candidates must also have at least one year of work experience. The applicant must also have one year of full-time work experience if the experience is in the field of public accounting. A work experience must also contain 24 semester hours that were completed within a twelve-month period. Breaks may be taken up to one (1) year.

Georgia CPA licensure requirements are to be met by applicants within 18 months following the completion of the first section. Candidates in exceptional situations cannot request extensions to their Notice of Schedule. Georgia licensure applications take approximately two to three week. Candidats will receive an acknowledgment email once their application is submitted. After the application is received, candidates will be sent an acknowledgment email.

CPA licenses expire on December 31 of odd-numbered years. Licenses must be renewed every two years by applicants. CPE is not required of licensees older than 70 years. CPA licensees are required to take a minimum of 80 hours of CPE courses each reporting cycle. At least 16 of these hours must be auditing or accounting courses. Licensees must also retain records of these CPE courses for five years. If an audit is requested, the licensee must show the board proof of CPE courses.

For more information, contact the State Board of Accountancy if you are interested in applying for a Georgia CPA license. For more information on licensure, they can visit the NASBA site.

FAQ

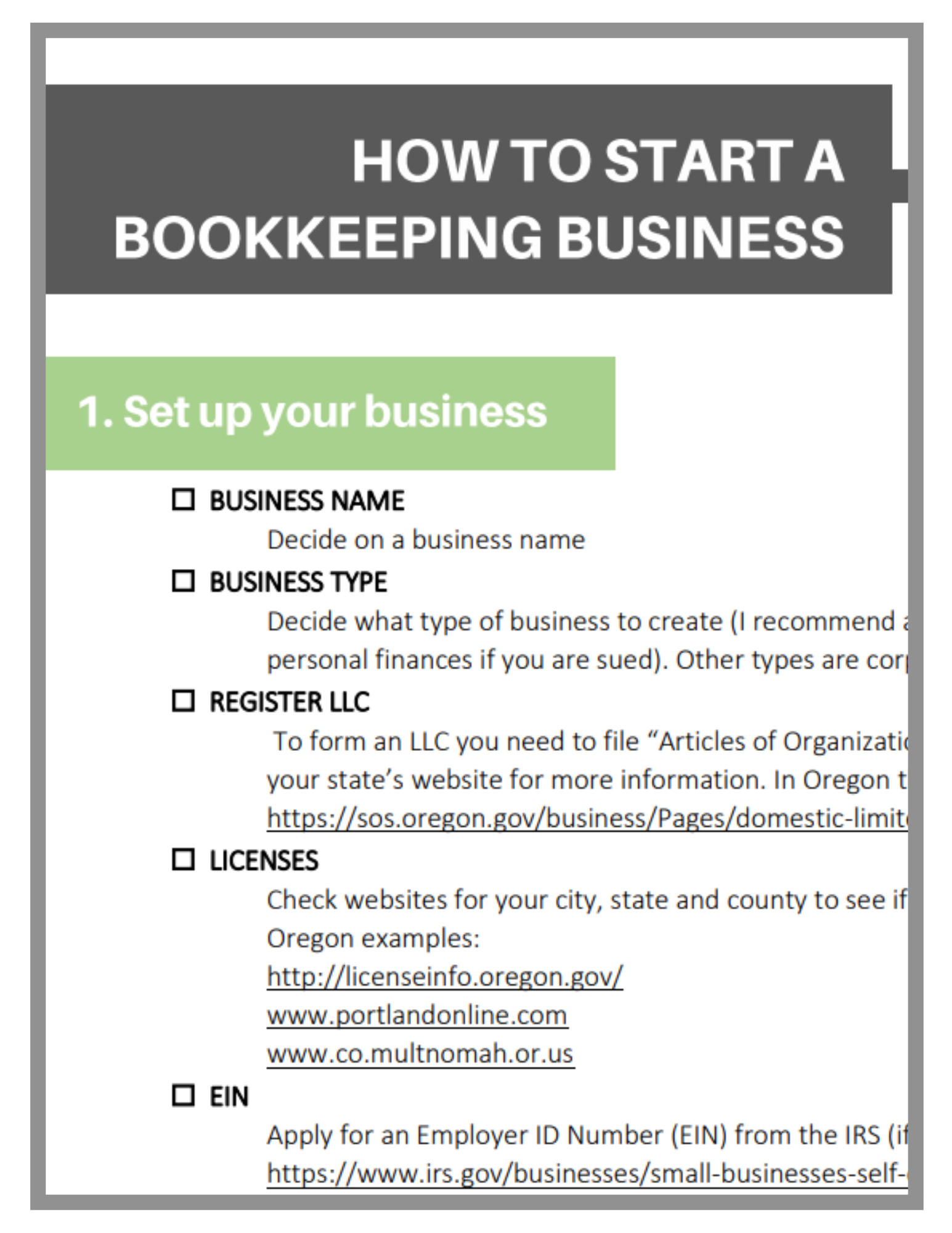

What exactly is bookkeeping?

Bookkeeping refers to the process of keeping financial records for individuals, companies, or organizations. It also includes the recording of all business-related income and expenses.

All financial information is tracked by bookkeepers. This includes receipts, bills, invoices and payments. They prepare tax returns, as well as other reports.

What does an auditor do?

An auditor looks for inconsistencies between the information given in the financial statements and the actual events.

He ensures that the figures provided are accurate.

He also validates the validity and reliability of the company's financial statements.

What's the significance of bookkeeping & accounting?

Bookkeeping and accounting is essential for any business. They enable you to keep track all of your expenses and transactions.

They also help you ensure you're not spending too much money on unnecessary items.

Know how much profit you have made on each sale. It is also important to know how much you owe others.

You may want to raise prices if there isn't enough money coming in. But, raising prices too high could result in customers being turned away.

If you have more than you can use, you may want to sell off some of your inventory.

You might be able to cut down on certain services and products if your resources are less than what you require.

All these factors can impact your bottom line.

What is a Certified Public Accountant and how do they work?

Certified public accountant (C.P.A.). An accountant with specialized knowledge is one who has been certified as a public accountant (C.P.A.). He/she will assist businesses with making sound business decisions and prepare tax returns.

He/She keeps an eye on the company's cash flow, and ensures that everything runs smoothly.

Statistics

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

Accounting: The Best Way

Accounting is a process and procedure that allows businesses track and record transactions accurately. Accounting includes the recording of income and expenses, keeping track of sales revenue, expenditures, and preparing financial statements and analysing data.

It also includes reporting financial information to stakeholders like shareholders, lenders and investors, customers and customers, etc.

Accounting can be done many different ways. There are many ways to do accounting.

-

You can also create spreadsheets manually.

-

Excel is a good choice.

-

Notes for handwriting on paper

-

Using computerized accounting system.

-

Online accounting services.

There are several ways to account. Each method has its advantages and disadvantages. Which one you choose will depend on your business model, needs and preferences. Before you decide to use any of these methods, make sure you consider their pros and cons.

In addition to being efficient, there are other reasons you may decide to use accounting methods. You might also want to keep good books if you are self employed. They can be used as evidence of your work. Simple accounting is best for small businesses with little money. Complex accounting is better if your company generates large cash flows.