Take a look at all of your options before making a decision about pursuing a finance degree. According to the Bureau of Labor Statistics, the field is expected to grow by five per cent by 2029. This is a faster rate than for all other occupations. After graduation, you should have job security and lots of career opportunities.

Alternatives to a finance degree

Finding a job may prove difficult after you have completed your finance degree. There are many career options available, regardless of whether you have enough experience or you have lost an interest in the financial market. These alternatives can be rewarding and may help you find hidden talents and skills. You will feel a sense of purpose and self-worth through these alternative routes.

Other options for a finance education include positions in insurance, public accounting and hedge funds, as well as finance consulting. You may even be able to find a job as a quantitative analyst, financial analyst, or regulatory compliance officer. These jobs are some of the highest paying financial fields and can take several years to complete.

A finance degree is required for most financial positions. However, there are other options for those who don't have the time or desire. These jobs require analytical skills as well as a willingness and ability to learn. A finance degree will also teach you soft skills that can be used in many other careers.

There are many career opportunities after you have completed a finance degree

You have many options for career opportunities after completing your finance degree. It is actually one of the most highly paid careers. Even entry-level jobs can make more than the median salary. If you're looking for the highest salary in a specific field, you might consider a PhD in Finance.

Finance can be done for corporations, government agencies or investment firms. You would be responsible for budget management and spending analysis. As a financial planner, you may also be able to work with individuals and families. You will be responsible for all the financial planning and needs of individuals and families.

Financial professionals are highly in demand across many industries, including entertainment and government. And their demand is projected to grow at 4% in the US over the next four years. Financial professionals are an essential part of any organization.

Cost of a finance degree

A finance degree can prepare you for a career that involves financial markets and money. Learn about risk, return, and investment types. You'll also learn how to use spreadsheets for key business performance indicators. You will also learn about economics and accounting. You could focus on taxation and corporate finance, or study the relationship between money (and society).

A bachelor's in finance typically takes four years. It consists of courses that include math, statistics and business. An undergraduate degree in finance costs between $24,000 and $75,000 so be sure to calculate the cost before you enroll. A finance online degree can help you save money, and you can balance your studies with work.

Cost of a finance degree is dependent on many factors. Some colleges charge more for graduate programs than they do for undergraduate degrees. Others charge less. Dual enrollment is also an option to cut costs. Also, you should look into financial aid options that may help you pay for your degree.

FAQ

What is the difference in Chartered Accountant and a CPA?

Chartered accountants are accountants who have passed all the necessary exams to get the designation. Chartered accountants are typically more experienced than CPAs.

Chartered accountants are also qualified in tax matters.

The average time to complete a chartered accountancy program is 6-8 years.

What does it entail to reconcile accounts?

The process of reconciliation involves comparing two sets. The "source" set is known as the "reconciliation," while the other is the "reconciled".

The source contains actual figures. While the reconciled indicates the figure that should not be used,

You could, for example, subtract $50 from $100 if you owe $100 to someone.

This ensures there are no errors in the accounting system.

What kind of training does it take to be a bookkeeper

Basic math skills such as addition and subtraction, multiplication or division, fractions/percentages, simple algebra, and multiplication are essential for bookkeepers.

They need to also be able and confident in using a computer.

Most bookkeepers have a high school diploma. Some may even hold a college degree.

What does an auditor do?

Auditors look for inconsistencies among the financial statements' information and the actual events.

He confirms the accuracy and completeness of the information provided by the company.

He also confirms the accuracy of the financial statements.

What are the main types of bookkeeping system?

There are three main types: hybrid, computerized, and manual bookkeeping systems.

Manual bookkeeping is the use of pen and paper to keep records. This method requires constant attention.

Software programs are used for computerized bookkeeping to manage finances. It saves time and effort.

Hybrid bookkeeping uses both manual and computerized methods.

What should I expect from an accountant when I hire them?

Ask questions about experience, qualifications and references before hiring an accountant.

You want someone who has done this before and knows what he/she is doing.

Ask them if they have any knowledge or skills that might be useful to you.

Make sure they have a good name in the community.

Statistics

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

The Best Way To Do Accounting

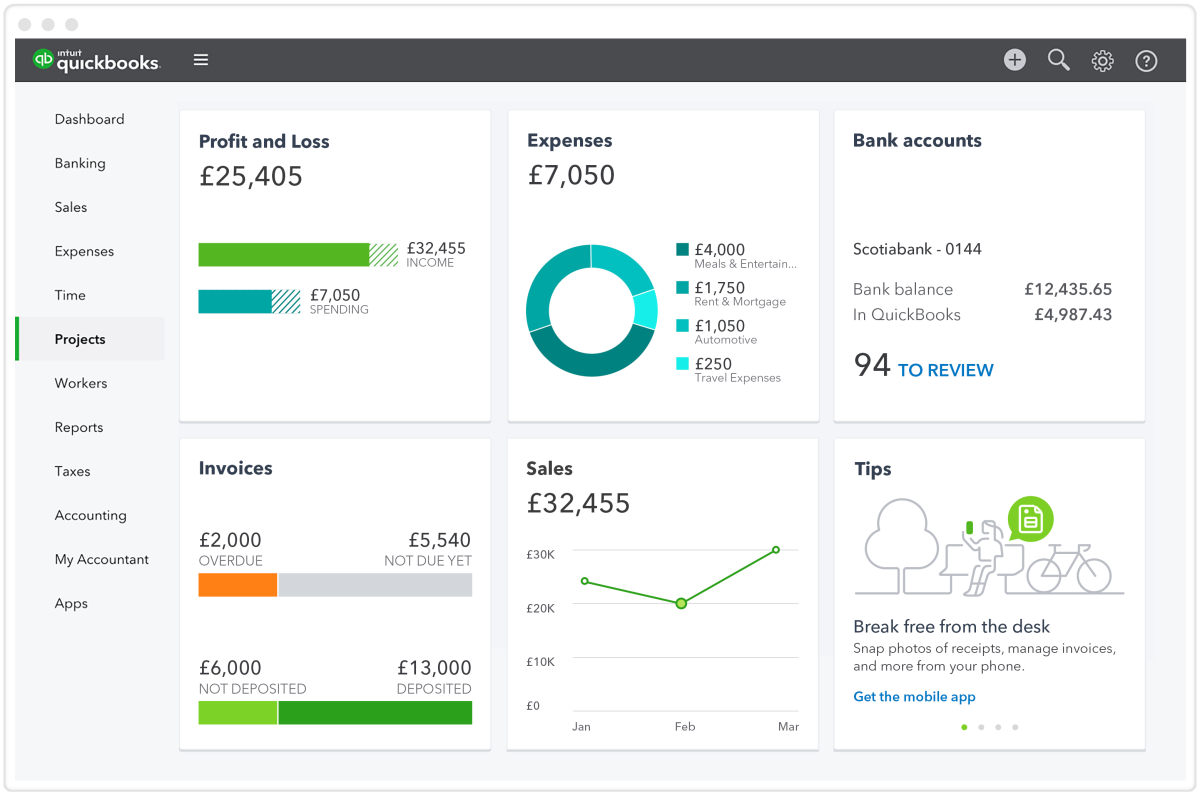

Accounting is a process and procedure that allows businesses track and record transactions accurately. It includes recording income, expense, keeping records sales revenue and expenditures as well as creating financial statements and analyzing data.

It also involves reporting financial data to stakeholders such shareholders, lenders investors customers, investors and others.

There are many ways to do accounting. There are several ways to do accounting.

-

Create spreadsheets manually

-

Excel can be used.

-

Handwriting notes on paper.

-

Use computerized accounting systems.

-

Online accounting services.

Accounting can be done in many different ways. Each method has advantages and disadvantages. The type of business you have and the needs of your company will determine which method you choose. You should always consider the pros and cons before choosing any method.

Accounting methods are not only more efficient, they can also be used for other reasons. If you're self-employed, for example, it might be a good idea to keep accurate books as they can provide proof of your work. If your business is small and does not have much money, you may prefer to use simple accounting methods. If your business is large and generates large amounts cash, it might be a good idea to use more complex accounting methods.