If you're considering a career in accounting, there are several options to choose from. These include working for a large organization, working for one of the "Big Four" accounting firms, and even starting your own firm. Here are some of the benefits and cons for each option. Which one would be best for you? Which one will have the greatest impact on your salary? Which path will give you a better income? What experience are necessary to succeed in this career?

A single organization.

If you are considering an accounting career path, working for a single organization might not be the best fit. An average stay at an entry-level post is one to five years. This will depend on the organization, the economy, and any opportunities that exist elsewhere. In this article we assume that you will be staying at the same employer for one-year. Final decision is up to you.

The ability to earn a high salary

If you love to crunch numbers, an accounting career may be right for you. Accounting is a popular career option because it pays a median salary of $92,246, which is a high average. As head of an accounting division, you will be responsible for all aspects related to a company's finances. These include financial statements, general ledger, payroll, accounts payable and receivable, and tax compliance. You'll also work on budgeting and tax compliance.

Many accountants work as partners or CFOs in large companies. Some accountants work alone, helping clients to complete their tax returns. With high salaries in accounting jobs, it is possible to work from your home. It just requires a bit of creativity and determination. But if you're determined, you'll find a high-paying accounting job that doesn't require a big commute or much travel.

Working for a "Big Four" accounting firm

Many people have dreams of working in one of the Big Four accounting companies. But what are the advantages and disadvantages? There are many reasons to join a Big Four firm if your goal is to become an accountant. Here are the pros and disadvantages of working at a Big Four firm over a regional company. This will help you decide if this is the right job for you.

You must demonstrate the qualities that make a great employee for a Big Four business when you apply to one. You must have confidence and be determined to work for the company, its clients. You must also demonstrate your dedication to the company's vision and be able show emotional intelligence. In addition to these attributes, you should have strong computer skills and an understanding of accounting and tax laws.

Starting your own accounting firm

There are several key factors to keep in mind when starting a new accounting company. There are many benefits to owning your own accounting firm. However, you need to be ready to invest some time researching. Legally starting a business requires that you know what your certifications and education can allow you to legally offer your clients. For example, only a CPA is allowed to file reports with SEC. This can make it difficult to find clients.

Entrepreneurship can allow you to combine your accounting skills along with your entrepreneurial spirit. You can start a business from your home, with the support of family members and flexible work hours. While you might not have full control over your business' strategic direction, you have the freedom to do what you enjoy most. A small company can thrive with just a few accountants. So you need to think about how your skills can be of benefit to your clients.

FAQ

What are the steps to get started with keeping books?

For you to begin keeping your books, you'll need a few things. These items include a notebook and pencils, calculator, staplers, envelopes, stamps and a filing drawer or desk drawer.

What does an auditor do exactly?

Auditors look for inconsistencies between financial statements and actual events.

He ensures that the figures provided are accurate.

He also verifies that the company's financial statements are valid.

What is the difference between a CPA (Chartered Accountant) and a CPA (Chartered Accountant)?

Chartered accountants are accountants who have passed all the necessary exams to get the designation. Chartered accountants are typically more experienced than CPAs.

Chartered accountants are also qualified in tax matters.

It takes 6 to 7 years to complete a chartered accounting course.

How long does it usually take to become a certified accountant?

The CPA exam is necessary to become an accountant. Most people who are interested in becoming accountants have studied for at least 4 years before taking the exam.

After passing the test one must have worked for at minimum 3 years as an Associate before becoming a Certified Public Accountant (CPA).

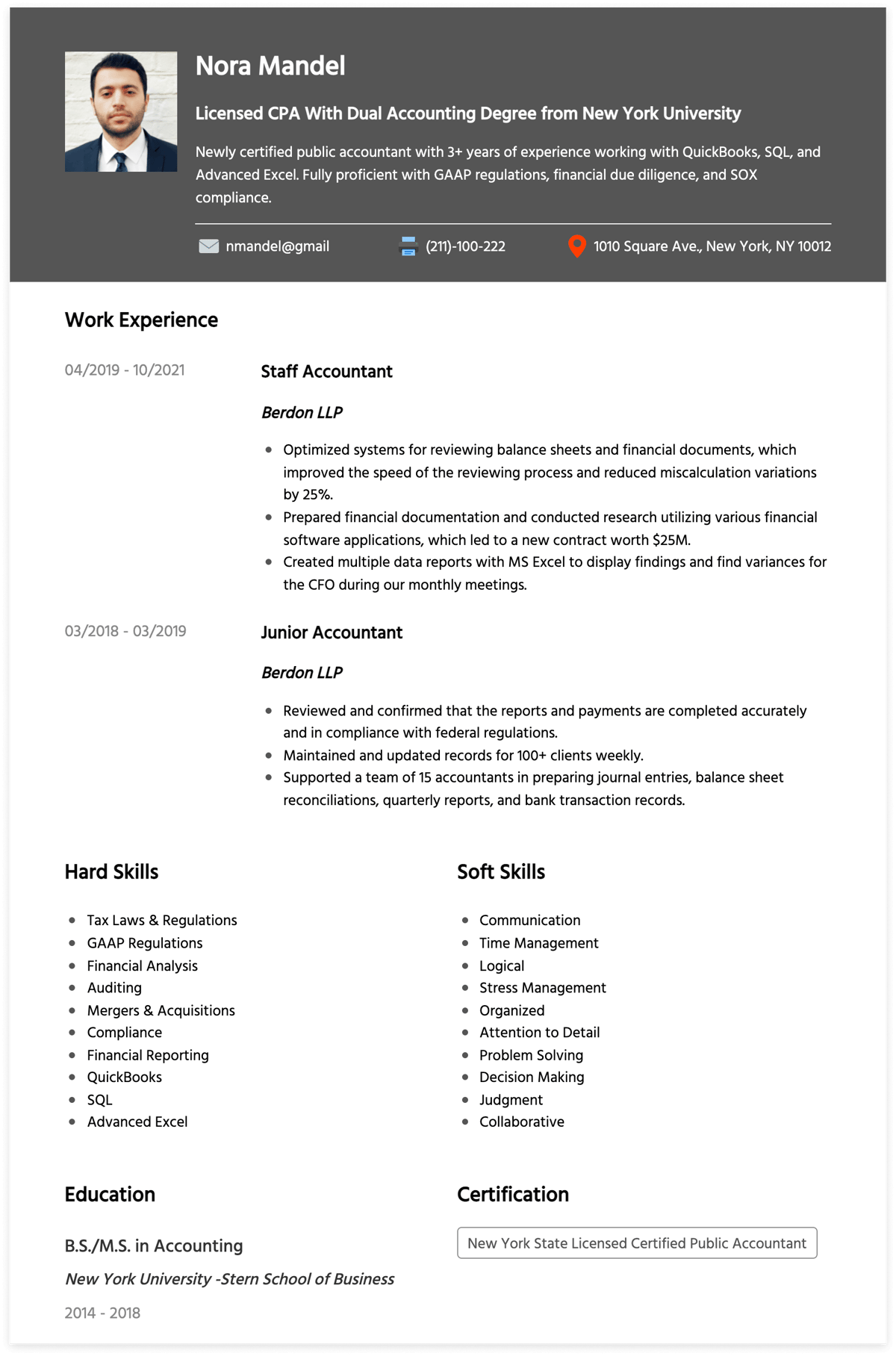

What should I expect from an accountant when I hire them?

Ask questions about their experience, qualifications, references, and other relevant information when hiring an accountant.

You want someone who's done this before and who knows the ropes.

Ask them if you could benefit from their special skills and knowledge.

Make sure they have a good name in the community.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

External Links

How To

How to bookkeeping

There are many accounting software options available today. Some are free, some cost money, but most offer basic features such as invoicing, billing, inventory management, payroll processing, point-of-sale systems, and financial reporting. The following list provides a brief description of some of the most common types of accounting packages.

Free Accounting Software: This accounting software is generally free and can be used only for personal purposes. Although the program is limited in functionality (e.g. it cannot be used to create your reports), it can often be very easy for anyone to use. A lot of free programs can be used to download data directly to spreadsheets. This makes them very useful for anyone who wants to do their own analysis.

Paid Accounting Software: Paid accounts are designed for businesses with multiple employees. These accounts provide powerful tools for managing employee records and tracking sales and expenses. They also allow you to generate reports and automate processes. The majority of paid programs require a minimum one-year subscription fee. However, some companies offer subscriptions that are less than six months.

Cloud Accounting Software: Cloud accounting software allows you to access your files anywhere online, using mobile devices such as smartphones and tablets. This type of program has become increasingly popular because it saves you space on your computer hard drive, reduces clutter, and makes working remotely much easier. You don't even need to install any additional software. All you need to access cloud storage is an Internet connection.

Desktop Accounting Software: Desktop accounting software is similar to cloud accounting software, except that it runs locally on your computer. Desktop software allows you to access your files anywhere, even via mobile devices, just like cloud software. However, unlike cloud software, you must install the software on your computer before you can use it.

Mobile Accounting Software: Our mobile accounting software can be used on smartphones and tablets. These programs let you manage your finances while on the go. They offer fewer functions than desktop programs, but are still useful for those who travel a lot or run errands.

Online Accounting Software: This online accounting software is intended primarily for small business. It includes everything that a traditional desktop package does plus a few extra bells and whistles. The best thing about online software is the fact that it does not require installation. You simply log in to the site to start the program. Another benefit is that you'll save money by avoiding the costs associated with a local office.