Are you interested in a career as an accountant? For information on qualifications, career outlook and salary ranges, read on. These are the 5 highest-paying accounting jobs. For more information, please get in touch. We'll help you make the right choice! We will be watching for positions that match your skills and interests. We will keep this information current as the field develops.

Qualifications

Accounting careers can be very rewarding. However, the pay scales will vary depending on the specialty and your experience. The CPA license will allow you to earn more money and open up many opportunities for advancement. Other professional certifications you may pursue, including the Certified Internal Auditor (CFA) and Certified Fraud Examiner (CIA), will also help increase your salary. While a college degree is not essential for a career in accounting, additional certifications and education may help you land a better job.

A career as an accountant is for you if you're passionate about numbers. The profession is in high demand and pays well. Earning a bachelor's degree in accounting will give you a wide range of opportunities in different fields. In addition to accounting, you may want to consider pursuing your CPA certification, which usually requires additional college coursework. Depending on your experience, you might even want to consider a career in forensic accounting.

Salary ranges

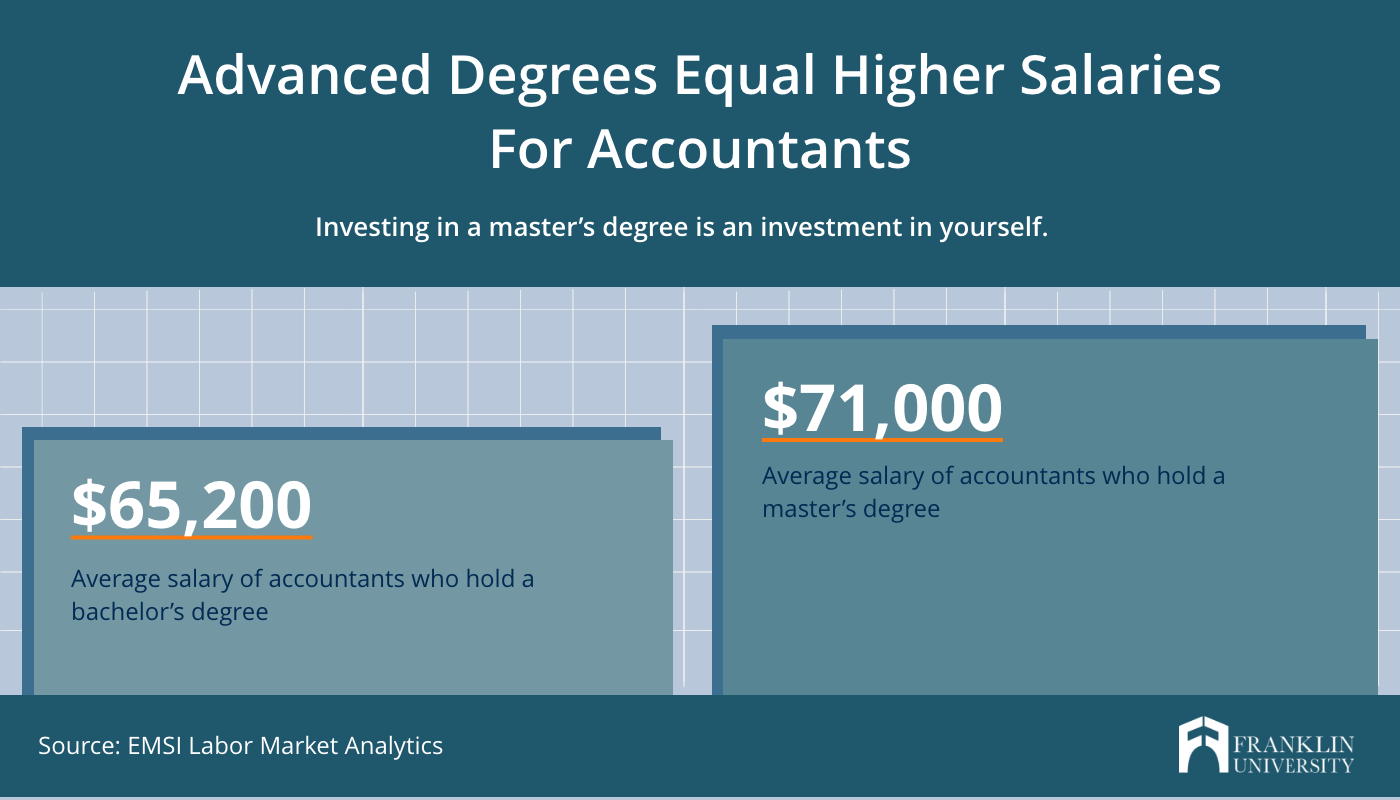

Although the salary ranges for accountant careers are varied, some are more lucrative than other. Senior professionals often command the highest salaries. The salary range for senior accountants, auditors, and cost accountants is between $70,000 and $120,000 per year. The range may be lower if you are an intern or an entry-level employee. Depending on your education level and experience, you can make between $57,110-$128,680 per annum.

Accounting and Finance professionals make an average salary of 117,000 USD annually. This means that 50% of Accounting and Finance professionals make less than this amount, while the other half earn more. The median is the middle-of the-road wage. The graph should be on the right. In general, salaries are more competitive if you have more experience. The average salary for an accountant in New York City is 125,000 US Dollars per year.

Perspectives on the job

According to the U.S. Bureau of Labor Statistics, there will be an 11 percent increase of accountants and auditors in 2021. There will also be a strong demand for financial managers, tax examiners, and personal financial advisers. According to the Bureau of Labor Statistics in 2017, the average accounting major salary was $57,250. This number can vary depending on where you live, your skill level and your experience.

Accounting jobs are well-positioned and the salaries available to them are highly competitive. Individuals with professional and high-level education have many opportunities. Salary ranges widely between regions and experience is a key factor in determining what you get paid. While some cities offer higher salaries than others, living costs can make it difficult for people to pay the extra. However, the overall outlook for accountants is good. Technological advancements are bringing new opportunities to the accounting industry. Students must decide their field of specialization, the credentials required, and the expected salary range before they pursue an accounting career.

FAQ

What are the signs that my company needs an accountant?

Companies often hire accountants once they reach certain sizes. A company may need an accountant if it has more than $10 million in annual sales.

Some companies, however, hire accountants regardless their size. These include sole proprietorships or partnerships, small firms, corporations, and large companies.

A company's size does not matter. Only what matters is whether or not the company uses accounting software.

If it does, then the company needs an accountant. A different scenario is not possible.

Do accountants get paid?

Yes, accountants get paid hourly.

Some accountants charge extra for preparing complicated financial statements.

Sometimes accountants may be hired to perform specific tasks. A public relations agency might hire an accountant to prepare reports showing the client's progress.

How do accountants function?

Accountants work with clients in order to get the best out of their money.

They also work closely with professional such as attorneys, bankers or auditors.

They also interact with departments within the company, such as sales and marketing.

Accountants are responsible to ensure that the books balance.

They determine the tax amount that must be paid to collect it.

They prepare financial statements that show the company's financial performance.

What happens to my bank statement if it is not reconciled?

If you fail to reconcile your bank statement, you may not realize that you've made a mistake until after the end of the month.

You will have to repeat the whole process.

What is the difference between accounting and bookkeeping?

Accounting is the study and analysis of financial transactions. The recording of these transactions is called bookkeeping.

They are both related, but different activities.

Accounting is primarily about numbers while bookkeeping is primarily about people.

To report on the financial health of an organization, bookkeepers must keep track of financial information.

They make sure all of the books balance by adjusting entries in accounts payable, accounts receivable, payroll, etc.

Accounting professionals analyze financial statements to assess whether they conform to generally accepted accounting procedures (GAAP).

They might recommend changes to GAAP, if not.

Bookskeepers record financial transactions in order to allow accountants to analyze it.

What are the benefits of accounting and bookkeeping?

Accounting and bookkeeping are essential for every business. They are essential for any business to keep track and monitor all transactions.

They can also help you avoid spending too much on unnecessary things.

You need to know how much profit you've made from each sale. Also, you will need to know how much debt you owe other people.

You may want to raise prices if there isn't enough money coming in. However, if your prices are too high, customers might not be happy.

Sell any inventory that you don't need.

You could reduce your spending if you have more than you need.

These things can have a negative impact on your bottom line.

What is the difference in Chartered Accountant and a CPA?

Chartered accountants are professional accountants who have passed the required exams to earn the designation. Chartered accountants are usually more experienced than CPAs.

Chartered accountants can also offer advice on tax matters.

A chartered accountancy course takes 6-7 years to complete.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

Accounting The Best Way

Accounting refers to a series of processes and procedures that enable businesses to accurately track and record transactions. It includes recording income and expenses, keeping records of sales revenue and expenditures, preparing financial statements, and analyzing data.

It also involves reporting financial results to stakeholders such as shareholders, lenders, investors, customers, etc.

Accounting can be done in many different ways. There are many ways to do accounting.

-

You can also create spreadsheets manually.

-

Excel is a good choice.

-

Handwriting notes on paper

-

Using computerized accounting systems.

-

Online accounting services.

Accounting can be done many ways. Each method has both advantages and disadvantages. Which one you choose depends on your business model and needs. Before you decide on any one method, consider all the pros and disadvantages.

Accounting methods are not only more efficient, they can also be used for other reasons. If you're self-employed, for example, it might be a good idea to keep accurate books as they can provide proof of your work. Simple accounting is best for small businesses with little money. However, complex accounting may be more appropriate for businesses that generate large amounts of cash.