There are many options available to you if accounting is something that interests you. These include working for a large organization, working for one of the "Big Four" accounting firms, and even starting your own firm. Below are the pros and cons of each career path. Which one would be best for you? And what will it do to your salary? Which path will lead you to a higher salary? What kind of experience is required to succeed?

A single organization.

You might not find the best job for your accounting career if you work for only one company. A majority of people will stay in an entry-level role for one to five more years. Of course, this also depends on the organization, economy, and opportunities elsewhere. In this article, we'll assume that you will stay at the same organization for one year. You will ultimately decide which work environment is right for you.

The ability to earn a high salary

Accounting may be the right career for you if you enjoy math. The median annual salary for accounting professionals is $92,246, making it an attractive career choice. As head of an accounting division, you will be responsible for all aspects related to a company's finances. These include financial statements as well as general ledger, payroll and accounts payable and dues. You'll also work on budgeting and tax compliance.

Some accountants work as partners in small businesses, while others work as CFOs in larger firms. Some accountants work alone, helping clients to complete their tax returns. It is possible to work from home, and earn high salaries in the accounting profession. It takes creativity and determination. But if you're determined, you'll find a high-paying accounting job that doesn't require a big commute or much travel.

Work for one of the "Big Four" accounting firms

Many people dream of working for one of the Big Four accounting firms, but what are the benefits and drawbacks of such a position? A Big Four firm is a great choice if you are looking to get an entry-level job in accounting. Here are the pros and disadvantages of working at a Big Four firm over a regional company. You can then decide if this position is right for you.

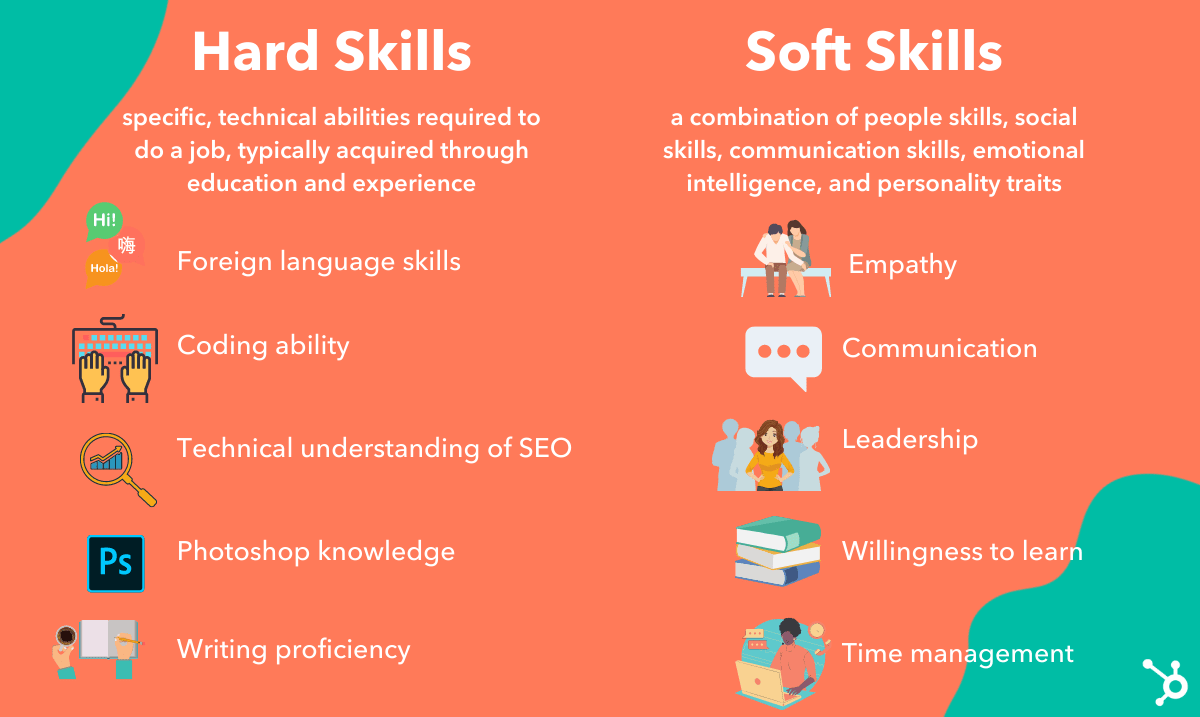

When applying to a Big Four firm, be sure to demonstrate the qualities that make a good employee for the company. You must have confidence and be determined to work for the company, its clients. You must also demonstrate your dedication to the company's vision and be able show emotional intelligence. In addition to these attributes, you should have strong computer skills and an understanding of accounting and tax laws.

Start your own accounting firm

These are the most important things to consider when starting an accounting firm. There are many benefits to owning your own accounting firm. However, you need to be ready to invest some time researching. It is important to understand what you are legally allowed to offer your clients. A CPA can file reports to the SEC. This can make it difficult to find clients.

Entrepreneurship is a great way to combine your accounting skills, with your entrepreneurial spirit. It's possible to start your own business, while still having the support and flexibility of your family. You may not be able to control the strategic direction of the business but you can focus on what you love. Small businesses can thrive with a small team, but accountants can be a great asset to their clients.

FAQ

What kind of training does it take to be a bookkeeper

Basic math skills are required for bookkeepers. These include addition, subtraction and multiplication, divisions, fractions, percentages and simple algebra.

They also need to know how to use a computer.

Many bookkeepers have a highschool diploma. Some even have college degrees.

What is Certified Public Accountant?

Certified public accountant (C.P.A.). A certified public accountant (C.P.A.) is an individual with special knowledge in accounting. He/she has the ability to prepare tax returns, and assist businesses in making sound business decision.

He/She also tracks cash flow and makes sure that the company runs smoothly.

What is an Audit?

An audit is an examination of the financial statements of a company. Auditors examine the company's books to verify everything is correct.

Auditors are looking for discrepancies among what was reported and actually occurred.

They also check whether the company's financial statements are prepared correctly.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

External Links

How To

How to do bookkeeping

There are many accounting software options available today. While some are free and others cost money, most accounting software offers basic features like invoicing, billing inventory management, payroll processing and point-of-sale. This list will give you a quick overview of some of the most popular accounting packages.

Free Accounting Software - This free software is often offered to personal use. Although the program is limited in functionality (e.g. it cannot be used to create your reports), it can often be very easy for anyone to use. You can also download data into spreadsheets with many free programs, which is useful if your goal is to analyze your company's financials.

Paid Accounting Software: These accounts are for businesses that have multiple employees. These accounts provide powerful tools for managing employee records and tracking sales and expenses. They also allow you to generate reports and automate processes. While most paid programs require a subscription fee for at least one-year, many companies offer subscriptions that last just six months.

Cloud Accounting Software: Cloud accounting software allows you to access your files anywhere online, using mobile devices such as smartphones and tablets. This program has gained popularity due to the fact that it frees up space on your hard drive, reduces clutter, is easier to use remotely, and also makes work more efficient. You don't even need to install any additional software. All that is required to access cloud storage services is an Internet connection.

Desktop Accounting Software: Desktop accounting software is similar to cloud accounting software, except that it runs locally on your computer. Desktop software allows you to access your files anywhere, even via mobile devices, just like cloud software. You will need to install the software on your PC before you can use it, however, unlike cloud software.

Mobile Accounting Software: Mobile accounting software is specifically designed to run on small devices like smartphones and tablets. These programs enable you to manage your finances even while you're on the move. Although they offer less functionality than full-fledged desktop applications, they are still very useful for people who travel or run errands.

Online Accounting Software: This software is primarily designed for small businesses. It includes everything that a traditional desktop package does plus a few extra bells and whistles. Online software doesn't need to be installed. All you have to do is log on and get started using it. Another advantage is the fact that you will save money because you won't have to go to a local office.