You have reached the right place if your goal is to complete an online course to be an accountant. This article will explain the requirements and the work that is required to obtain an accounting certification. We'll also cover the salary potential as well as the requirements for a certification to help you prepare to start your career as a financial specialist. What are accounting certifications exactly? How much are they? Which one would be best for you?

GED or High School Diploma

A high school diploma is commonly associated with high schools. However, it is not necessary to earn a college diploma in all cases. However, not everyone is prepared to go into debt for college. Online certificate programs are a great option. These programs are a great way to get the training you need without taking on excessive debt. Online accounting certificates can be earned from the comfort of your home.

GPA of 2.5+

If you're looking to earn your accounting certification online, your grade point average is an important factor to consider. What can you do to improve your chances for admission? You can work harder to increase your grade point average but it is best to apply for scholarships that do not require a minimum GPA. Sometimes, scholarships require that you have a minimum GPA 2.5.

To be eligible for admission to an online program, applicants must have a minimum 2.5 GPA. Even though this is more challenging in junior years, it is well worth it. Even a C turned into an A is an important step toward achieving junior class status. The applicant can also increase their GPA to 2.5 or 2.7, opening up more possibilities.

Required Coursework

An accounting certification can be a great option for many reasons. This certificate can be a fantastic way to grow your career. Online certificates are a great way to prove your graduate education and can even help you get promoted or move into a different area. In this article, we'll look at a few reasons why you should get an accounting certification online. These credentials will show that you are able to work in a more challenging job and keep up with the latest technologies.

First, a certificate course teaches the fundamentals and use of accounting software. You can also learn the foundations of management accounting. Online certificate programs can teach you cost accounting from a leadership perspective as well as basic costs and budgets. You might consider an advanced accounting degree if this is something you love. However, a certificate program doesn't guarantee you a job. If you aren't sure which program to choose, make sure it has regional accreditation.

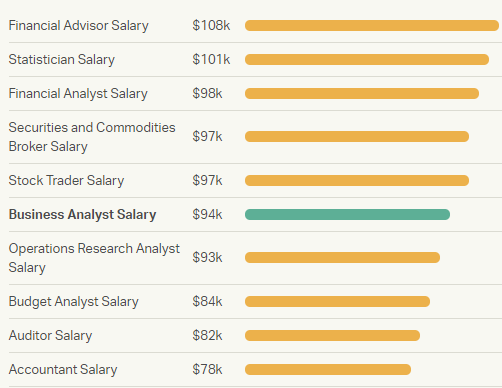

Salary

You can earn an online accounting certificate to help you get valuable skills for a wide range of job opportunities. Whether you're currently working in a corporate environment or would like to make a career change, earning your certificate can help you excel at your current position. You'll be better prepared to find a higher paying position with a certificate in your hand than without one. The best online certificate programs can help you gain skills that are desired by businesses of all sizes, including Fortune 500 companies and small-scale businesses.

Numerous online certificate programs provide basic accounting principles. Although they may not require algebra, it is a common requirement. You might consider including college algebra in your course selections if it is not something you already take. In addition to cost accounting, corporate finance will be covered. This can help you in your future career as a financial analyst. Learn how to make a budget and price items.

FAQ

What is the difference between a CPA and a Chartered Accountant?

Chartered accountants are professional accountants who have passed the required exams to earn the designation. A chartered accountant is usually more experienced than a CPA.

Chartered accountants are also qualified in tax matters.

It takes 6 to 7 years to complete a chartered accounting course.

What is bookkeeping?

Bookkeeping is the practice of maintaining records of financial transactions for businesses, organizations, individuals, etc. It includes recording all business-related expenses and income.

Bookkeepers keep track of all financial information, including receipts, invoices bills, payments, deposits and interest earned on investments. They also prepare tax returns as well other reports.

What happens to my bank statement if it is not reconciled?

You might not realize the error until the end, if you haven't reconciled your bank statement.

At this point, you will need repeat the entire process.

What is the difference between accounting and bookkeeping?

Accounting is the study of financial transactions. Bookkeeping is the documentation of such transactions.

Both are connected, but they are distinct activities.

Accounting deals primarily on numbers, while bookkeeping deals mostly with people.

To report on an organization's financial situation, bookkeepers will keep financial information.

They ensure all books balance by correcting entries in accounts payable and accounts receivable.

Accountants review financial statements to determine compliance with generally accepted Accounting Principles (GAAP).

If not, they may recommend changes to GAAP.

So that accountants can analyze the data, bookkeepers keep records about financial transactions.

How long does an accountant take?

Passing the CPA test is essential in order to become an accounting professional. Most people who wish to become accountants study for around 4 years before taking the exam.

After passing the exam, you must work at least three years as an associate to become a certified public accountant (CPA).

What does it entail to reconcile accounts?

Reconciliation involves comparing two sets of numbers. One set is called "source" and the other the "reconciled."

The source contains actual figures. While the reconciled indicates the figure that should not be used,

If you are owed $100 by someone, but receive $50 in return, you can reconcile it by subtracting $50 off $100.

This ensures there are no errors in the accounting system.

How do accountants function?

Accountants partner with clients to help them get the most out their money.

They collaborate closely with professionals like lawyers, bankers and auditors.

They also work with internal departments like human resources, marketing, and sales.

Accountants are responsible in ensuring that books are balanced.

They determine the tax due and collect it.

They also prepare financial reports that reflect how the company is doing financially.

Statistics

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

External Links

How To

How to become an accountant

Accounting is the science and art of recording financial transactions and analyzing them. It can also involve the preparation statements and reports for various purposes.

A Certified Public Accountant is someone who has passed and been licensed by the state board.

An Accredited Financial Advisor (AFA), is an individual that meets certain criteria established by American Association of Individual Investors. A minimum of five years' experience in investment is required by the AAII before an individual can become an AFA. To pass the examinations, they must have a good understanding of accounting principles.

A Chartered Professional Accountant is also known by the name chartered accountant. This is a professional accountant who received a degree at a recognized university. CPAs must comply with the Institute of Chartered Accountants of England & Wales’ (ICAEW) educational standards.

A Certified Management Accountant (CMA) is a certified professional accountant specializing in management accounting. CMAs must pass the ICAEW exams and continue their education throughout their careers.

A Certified General Accountant or CGA member of American Institute of Certified Public Accountants. CGAs have to pass several tests. One test is known as the Uniform Certification Examination.

A Certified Information Systems Auditor (CIA) is a certification offered by the International Society of Cost Estimators (ISCES). Candidates for the CIA need to complete three levels in order to be eligible. These include practical training, coursework and a final examination.

Accredited Corporate Compliance Office (ACCO), a designation conferred by the ACCO Foundation as well as the International Organization of Securities Commissions. ACOs are required to hold a baccalaureate degree in finance, business administration, economics, or public policy and must pass two written exams and one oral exam.

The National Association of State Boards of Accountancy gives the credential of Certified Fraud Examiner (CFE). Candidates must pass three exams and obtain a minimum score of 70 percent.

International Federation of Accountants is accredited a Certified Internal Audior (CIA). Candidates must pass four exams that cover topics such auditing, compliance and risk assessment.

American Academy of Forensic Sciences gives Associate in Forensic Accounting (AFE), a designation. AFEs must have graduated from an accredited college or university with a bachelor's degree in any field of study other than accounting.

What does an auditor do? Auditors are professionals who conduct audits of organizations' internal controls over financial reporting. Audits may be conducted on a random basis, or based in part on complaints made by regulators.