Considering a career as an accountant? Here are some pros and cons of both staff accountants and junior accountants. Both positions perform the same tasks, but the roles are not exactly the same. To gain insight into the differences between them, consider their job duties, education requirements, and potential salary ranges. If you're a recent college graduate, a junior accountant's day might include reviewing financial statements and preparing projection reports. These reports would typically be reviewed by executives in the company, but junior accountants rarely have direct access to these people. They'd instead work closely together with their supervisors or a supervising account.

The primary difference between a staff and junior accountant is in the requirements. The former requires a fouryear degree and one years of work experience. Staff accountants should be computer-literate and have excellent math and accounting skills. They must also have excellent communication skills and collaborative attitudes. Staff accountants usually report to a CPA or controller. Unlike junior accountants, staff accountants can advance their careers if they demonstrate the necessary skills.

An entry-level position within an accounting firm is the staff accountant. They often hold the same credentials as a junior accountant, but have more experience and responsibility. Staff accountants typically have more experience than junior accountants and can handle more complex tasks. Entry-level accountants spend the majority of their time creating budgets and balance sheets. Staff accountants are often involved in larger projects, such as audits and internal controls.

As the BLS reports, the median annual salary for accountants was $60,340 in May 2009, with the lowest 10% earning $37,690. Salaries for staff accountants start off low and then increase as you get more experience. Senior staff accountants make up the top 10% of earners. The majority of junior staff accountant positions include benefits like health insurance, paid leave, and dental insurance. A minimum of an associate's in accounting is required for junior staff accountant roles.

You can become a staff accountant, or a junior accountant depending on how skilled and experienced you are. An assistant manager is more likely to be a staff accountant. Although a junior accountant may be the entry-level job, they should still be meticulous and have a good knowledge of accounting software and computers. They should also have a solid understanding of accounting, including invoicing, payroll, and corporate tax guidelines. Although a junior accountant may work under the direct supervision of a senior staff member accountant, the senior accounting manager usually plays a more strategic part and manages the company’s finances.

A junior accountant is an entry level accountant who has similar responsibilities to a staff accountant. They prepare asset, liability, and capital account entries, perform audits, and analyze accounting options. Junior accountants assist with the preparation of financial statements, financial reports, as well as paying monthly payroll. While these positions are usually full-time, many work overtime. Ask about the expectations of the company when you are looking for staff accountants.

FAQ

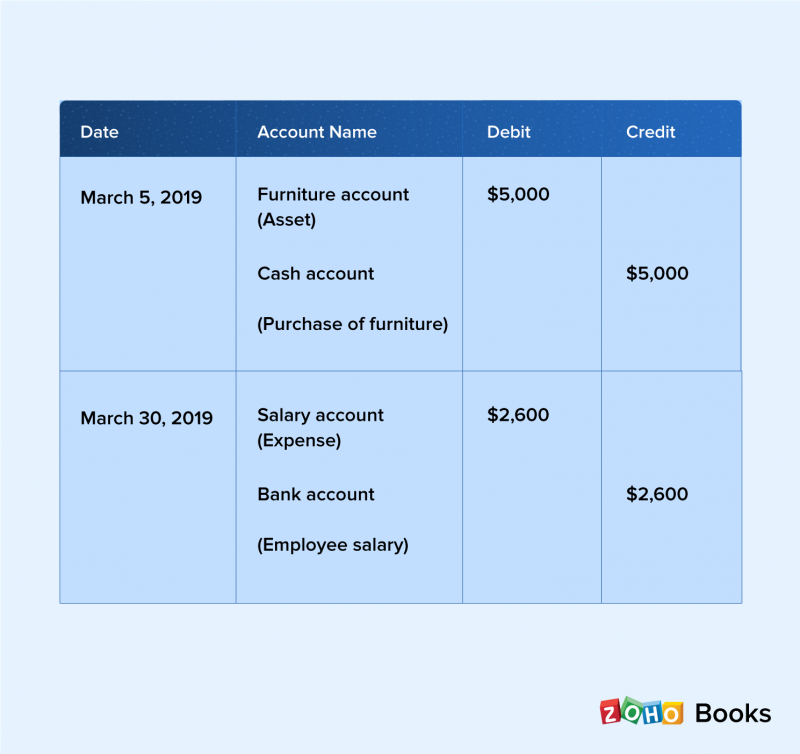

What is the distinction between bookkeeping or accounting?

Accounting is the study and analysis of financial transactions. These transactions are recorded in bookkeeping.

They are both related, but different activities.

Accounting deals primarily using numbers, while bookskeeping deals primarily dealing with people.

To report on the financial health of an organization, bookkeepers must keep track of financial information.

They ensure that all the books are balanced by correcting entries for accounts payable, accounts receivable or payroll.

Accounting professionals analyze financial statements to assess whether they conform to generally accepted accounting procedures (GAAP).

They may suggest changes to GAAP if they do not agree.

Accounting professionals can use the financial transactions that bookkeepers have kept to analyze them.

What's the significance of bookkeeping & accounting?

Bookkeeping and accounting are important for any business. They help you keep track of all your transactions and expenses.

They will help you to avoid overspending on unnecessary items.

You should know how much profit your sales have brought in. It's also necessary to know your responsibilities to others.

If you don't have enough money coming in, then you might want to try raising prices. But, raising prices too high could result in customers being turned away.

You may be able to sell some inventory if you have more than what you need.

If you have less than you need, you could cut back on certain services or products.

All these factors can impact your bottom line.

What's the difference between a CPA or Chartered Accountant?

Chartered accountants are professional accountants who have passed the required exams to earn the designation. Chartered accountants are usually more experienced than CPAs.

Chartered accountants can also offer advice on tax matters.

The course of chartered accountantancy takes approximately 6 years.

What should I expect from an accountant when I hire them?

Ask questions about their experience, qualifications, references, and other relevant information when hiring an accountant.

You want someone who's done this before and who knows the ropes.

Ask them if they have any special skills or knowledge that would be helpful to you.

Be sure to establish a good reputation within the community.

Accounting: Why is it useful for small-business owners?

Accounting isn't just for big companies. It is useful for small-business owners as it helps them track all the money that they spend and make.

If you run a small business, you likely know how much money comes in each month. But what happens if you don’t have a professional accountant to help you with this? It's possible to be confused about where your money is going. Or you could forget to pay bills on time, which would hurt your credit rating.

Accounting software makes it simple to track your finances. There are many options. Some are completely free, while others can cost hundreds of thousands of dollars.

But whatever type of accounting system you use, you'll want to understand its basic functions first. You won't have to spend time learning how it works.

These are the basics of what you should do:

-

Record transactions in the accounting system.

-

Keep track of income and expenses.

-

Prepare reports.

After you have mastered these three points, you can start to use your new accounting software.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

External Links

How To

How to get a Accounting degree

Accounting is the process of keeping track of financial transactions. It can be used to record transactions between individuals and businesses. The term account refers to bookskeeping records. Accountants prepare reports based on these data to help companies and organizations make decisions.

There are two types: general (or corporate) and managerial accounting. General accounting deals with reporting and measuring business performance. Management accounting is concerned with measuring, analysing, and managing organizations' resources.

An accounting bachelor's degree prepares students for entry-level positions as accountants. Graduates might also be able to choose to specialize, such as in auditing, taxation, finance or management.

Students who want to pursue a career in accounting should have a good understanding of basic economics concepts such as supply and demand, cost-benefit analysis, marginal utility theory, consumer behavior, price elasticity of demand, and the law of one price. They will need to be familiar with accounting principles and different accounting software.

Students interested in pursuing a Master's degree in accounting must have passed at least six semesters of college courses, including Microeconomic Theory; Macroeconomic Theory; International Trade; Business Economics; Financial Management; Auditing Principles & Procedures; Accounting Information Systems; Cost Analysis; Taxation; Managerial Accounting; Human Resource Management; Finance & Banking; Statistics; Mathematics; Computer Applications; and English Language Skills. Graduate Level Examinations must also be passed. This examination is usually taken following three years of studies.

To become certified public accountants, candidates must complete four years of undergraduate studies and four years of postgraduate studies. Before they can apply for registration, candidates will need to take additional exams.