Accountants are people who prepare, analyze, and maintain financial records. They can be employed by businesses, government agencies, or individuals. Accountants have strong organizational, communication, and problem-solving skills. A lot of people opt to work at home, allowing them the freedom and independence that an accounting career offers. This article will focus on the positive aspects of this profession. Find out how to get started and what career opportunities are available.

Accountants prepare, analyze, manage, and maintain financial records

Accounting is a profession that focuses on the preparation, analysis, and maintenance of financial records. Some accountants are experts in certain industries like law or government. Forensic accountants are able to analyze financial records and investigate fraud or other financial crimes. They are also available to assist in external and internal audits. Accounting professionals in this field can also investigate financial crimes like embezzlement, securities fraud and other illegal activities.

Most accountants work in a office environment. Some accountants may need to travel to clients offices or audit financial records. An accountant may prepare tax returns to be filed with the IRS or for other entities. Other tasks may include financial audits and budget preparation. And many of them also perform general office duties. Here are some common occupations held by accountants. Learn more about this exciting career.

They work with individuals, businesses and government agencies.

Many people believe that accounting is their sole reason for wanting to work in the financial industry. They enjoy organizing and analyzing large numbers of financial data. Accounting professionals can have many responsibilities. However, they may also be chief financial officers. This involves giving advice and direction to clients, government agencies and companies. A lot of people are interested in an accounting career to have a competitive edge in the job search.

There are many types of accounting careers. Each branch requires different education. Some jobs in accounting require additional education or certifications. Others do not. To be successful in your career, it is important to know the differences among these roles. The following are some of the types of jobs in accounting. You can choose from accounting jobs that focus on taxation, government accounting, or corporate accounting.

They have strong organizational, communication, and problem-solving skills

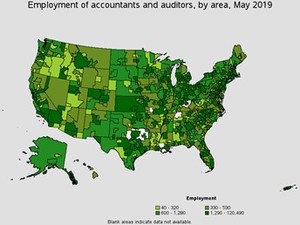

The Bureau of Labor Statistics keeps track of the employment of accountants. There are several different types of accounting and finance jobs. These include tax preparation and accounting as well as manufacturing and government. A lot of accountants work with spreadsheets or general ledger functions. Candidates should be good at communicating and interfacing with others, and have great analytical and problem-solving skills. Candidates must possess strong organizational skills as well as a keen eye.

It is important to be aware of your strengths and weaknesses when considering a career in accounting. Accounting careers will benefit from people who have a natural aptitude for math and problem-solving skills. This field requires that people spend considerable time analysing financial statements and reconciling bookkeeping ledgers. For clients and colleagues to be able talk to you, it is essential that you have good communication skills.

They can work from their home

There are many work-at-home opportunities available for accountants and bookkeepers. A computer, an internet connection and a dedicated telephone line are essential. You will need a headset and printer. Multifunction devices are likely to save you money. An accounting software package will be required to allow you to complete all tasks.

FlexJobs.com is a great site to search for an accounting job. FlexJobs specializes in remote job opportunities, including full-time, entry-level and part-time positions. Take a free tour and get a feel of the system before you make a payment. You can also use FlexJobs to power your search for at-home accounting positions. The company's website provides information about all the features and services available.

FAQ

What does an auditor do?

An auditor looks for inconsistencies between the information given in the financial statements and the actual events.

He confirms the accuracy and completeness of the information provided by the company.

He also verifies that the company's financial statements are valid.

Why Is Accounting Useful for Small Business Owners?

Accounting is not only for large businesses. Accounting is beneficial to small business owners as it helps them keep track and manage all the money they spend.

If you run a small business, you likely know how much money comes in each month. What happens if an accountant isn't available to you? It's possible to be confused about where your money is going. It is possible to forget to pay your bills on a timely basis, which can negatively affect your credit rating.

Accounting software makes keeping track of your finances easy. And there are many different kinds available. Some are absolutely free while others may cost hundreds or even thousands of dollars.

No matter what type of accounting system, it is important to first understand the basics. By doing this, you will not waste time learning how to operate it.

These are three basic tasks that you need to master:

-

Record transactions in the accounting system.

-

Keep track of incomes and expenses.

-

Prepare reports.

Once you have these three skills, you are ready to begin using your new accounting program.

What are the salaries of accountants?

Yes, accountants usually get paid hourly rates.

Complicated financial statements can be a charge for some accountants.

Sometimes accountants can be hired to do specific tasks. An example of this is a public relations firm that might hire an accountant for a report on how the client is doing.

What is the importance of bookkeeping and accounting?

Bookskeeping and accounting are vital for any business. They help you keep track of all your transactions and expenses.

They also make it easier to save money on unnecessary purchases.

Know how much profit you have made on each sale. It is also important to know how much you owe others.

If you don’t have enough money, you might think about raising the prices. However, if your prices are too high, customers might not be happy.

You may be able to sell some inventory if you have more than what you need.

You can reduce the number of products or services you use if you have less money.

All these things will have an impact on your bottom-line.

What are the types of bookkeeping software?

There are three main types: hybrid, computerized, and manual bookkeeping systems.

Manual bookkeeping involves using pen and paper for records. This method requires constant attention.

Software programs can be used to manage finances through computerized bookkeeping. This saves time, effort, and money.

Hybrid bookkeeping combines both manual and computerized methods.

What is an accountant and why are they so important?

An accountant tracks all your money, both earned and spent. They also keep track of the tax you pay and any deductions.

Accounting helps you manage your finances by keeping track your income and expenses.

They help prepare financial reports for businesses and individuals.

Accountants are needed because they have to know everything about the numbers.

A professional accountant can also help with taxes, so that people pay as little tax as they possibly can.

What should I expect when hiring an accountant?

Ask about their qualifications, experience, and references when interviewing an accountant.

You need someone who is experienced in this type of work and can explain the steps.

Ask them if you could benefit from their special skills and knowledge.

Make sure that they are well-respected in the local community.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to do bookkeeping

There are many types of accounting software available today. While some are free and others cost money, most accounting software offers basic features like invoicing, billing inventory management, payroll processing and point-of-sale. The following list provides a brief description of some of the most common types of accounting packages.

Free Accounting Software: This accounting software is generally free and can be used only for personal purposes. While it might not be as functional as you would like (e.g. you cannot create reports), the software is usually very simple to use. If you are interested in analyzing your business' numbers, many programs allow you to directly download data to spreadsheets.

Paid Accounting Software: Paid accounts are designed for businesses with multiple employees. These accounts provide powerful tools for managing employee records and tracking sales and expenses. They also allow you to generate reports and automate processes. The majority of paid programs require a minimum one-year subscription fee. However, some companies offer subscriptions that are less than six months.

Cloud Accounting Software: You can access your files from anywhere online using cloud accounting software. This type of program has become increasingly popular because it saves you space on your computer hard drive, reduces clutter, and makes working remotely much easier. It doesn't require you to install additional software. You just need an Internet connection and a device capable to access cloud storage.

Desktop Accounting Software: Desktop accounting software is similar to cloud accounting software, except that it runs locally on your computer. Like cloud software, desktop software lets you access your files from anywhere, including through mobile devices. However, unlike cloud software, you must install the software on your computer before you can use it.

Mobile Accounting Software: This mobile accounting software was specifically developed to work on tablets and smartphones. These programs enable you to manage your finances even while you're on the move. They have fewer functions that full-fledged desktop apps, but they're still extremely useful for people who travel often or run errands.

Online Accounting Software is specifically designed for small businesses. It contains all the functions of a traditional desktop application, as well as some additional features. Online software doesn't need to be installed. All you have to do is log on and get started using it. You can also save money and avoid the overheads of a local office.