A CA salary can vary significantly depending on location. It can range from $20 to 25 millions per year, on average. You have many opportunities to raise your salary if the CA exam scores well. However, your education and career path is the most important aspect of determining your salary. We'll be discussing the most popular salary ranges for CAs and some tips for government job hunters.

CA's salary depends on where they live.

The salary of a CA depends on many factors. There are many factors that contribute to a CA's salary. These include experience in the field as well as willingness and ability to learn new skills. However, there are also some additional factors that determine a CA's salary. These are just a few of the common factors. There is no one right answer. Here are some tips for increasing your CA salary.

India's highest paid profession, Chartered accountants, is among them

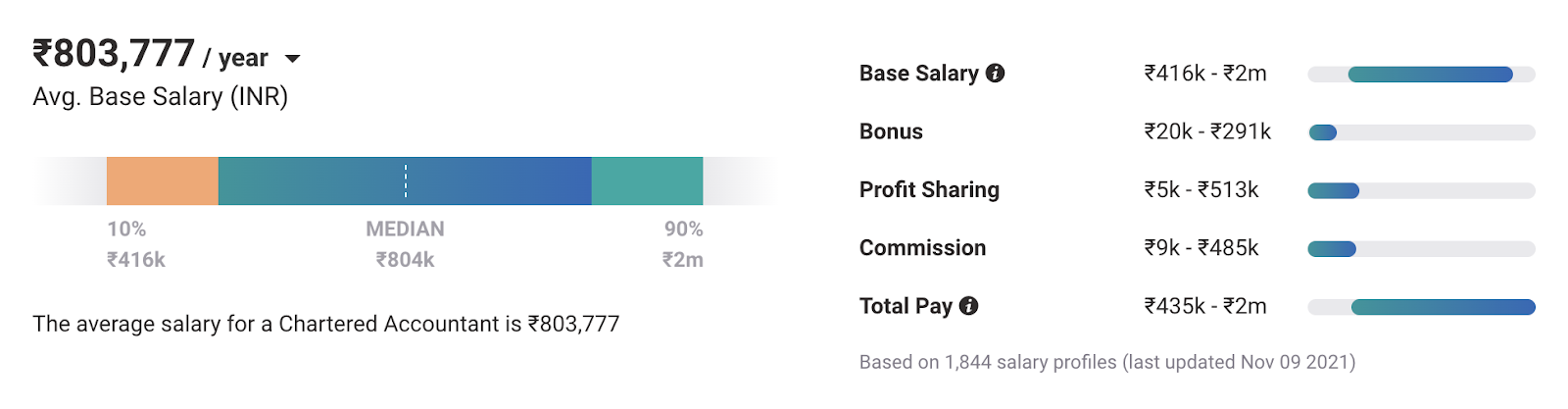

Chartered Accountants rank among the highest-paid professions. Their skills, knowledge, ability to manage stress and their salary are the key factors in determining their income. CAs start off with a salary between six and twenty-four thousand. CAs are considered to be in good employment security due to their increased demand. The top recruiters of CAs include BHEL, Citibank, and BHEL. While lawyers are portrayed as high-fliers, they also have some of the highest-paid jobs in the world.

The Big 4 accounting firms may hire those who are more successful. Starting pay is between six and eight lacs, and with experience, the package can increase to twenty-four or twenty-five lacs. The annual salary of Chartered Accountants is between twenty four and twenty-five million. Their work can help them earn more. But stress can lead to early resignations.

A government job is possible for Chartered Accountants.

There are many government jobs that Chartered Accountants can apply for. Some of the best government jobs for CAs are offered by GAIL, the state-owned natural gas processing and distribution company. Check out the official website for the latest job openings. GAIL has several opportunities for Chartered Accountants to work as bookkeepers in the company's financial records or as general managers of department finance or government-owned bank branches. They can also be designated loans or as assistant administrative officers in emergencies.

Chartered Accountants may be eligible for various government jobs. Some government jobs include managing finances for government agencies, performing audits, managing finance, reporting, and other administrative tasks. You can also work as a Chartered accountant in the tax department. CAs have many options for government jobs. These positions pay a good salary. These positions come with a high salary.

FAQ

What is an accountant and why are they so important?

An accountant keeps track all the money that you earn and spend. An accountant also records how much tax you have to pay and the deductions that are allowed.

An accountant can help you manage your finances and keep track of your incomes and expenses.

They can prepare financial reports both for individuals and companies.

Accountants are necessary because they must be knowledgeable about all things numbers.

Accounting also assists people in filing taxes and ensuring that they pay as little as possible tax.

What should you expect when you hire an accountant?

Ask questions about the qualifications and experience of an accountant when you are looking to hire them.

You need someone who is experienced in this type of work and can explain the steps.

Ask them about any skills or knowledge they may have that could be of assistance to you.

Make sure they have a good name in the community.

How do accountants function?

Accountants work with clients in order to get the best out of their money.

They are closely connected to professionals such as bankers, lawyers, auditors, appraisers, and auditors.

They also support internal departments such marketing and sales.

Accounting professionals are responsible for maintaining balance in the books.

They determine how much tax must be paid, and then collect it.

They also prepare financial reports that reflect how the company is doing financially.

Why is reconciliation important?

It is vital because mistakes can happen at any time. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can cause serious consequences, including inaccurate financial statements, missed deadlines, overspending, and bankruptcy.

What is accounting's purpose?

Accounting is a way to see a financial picture by recording, analyzing and reporting transactions between people. Accounting allows organizations to make informed decisions about how much money they have available to invest, how much they can expect to earn from operations and whether additional capital is needed.

Accountants track transactions in order provide financial activity information.

The company can then plan its future business strategy, and budget using the data it collects.

It is crucial that the data are accurate and reliable.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to Become a Accountant

Accounting is the science behind recording transactions and analysing financial data. It can also involve the preparation statements and reports for various purposes.

A Certified Public Accountant or CPA is someone who has passed an exam and received a license from the state board.

An Accredited Financial Analyst (AFA), is someone who has met certain criteria set by the American Association of Individual Investors. A minimum of five years' experience in investment is required by the AAII before an individual can become an AFA. To pass the examinations, they must have a good understanding of accounting principles.

A Chartered Professional Accountant or CPA (sometimes referred to simply as a chartered accountant) is a professional accounting who has received a degree in accounting from a recognized university. CPAs must comply with the Institute of Chartered Accountants of England & Wales’ (ICAEW) educational standards.

A Certified Management Accountant is a professional accountant who specializes in management accounting. CMAs must pass exams administered annually by the ICAEW. They also need to continue continuing education throughout their careers.

A Certified General Accountant (CGA) member of the American Institute of Certified Public Accountants (AICPA). CGAs have to pass several tests. One test is known as the Uniform Certification Examination.

The International Society of Cost Estimators offers the certification of Certified Information Systems Auditor (CIA). The three-level curriculum for CIA candidates includes practical training, coursework, and a final exam.

An Accredited Corporate Compliance Officer (ACCO) is a designation granted by the ACCO Foundation and the International Organization of Securities Commissions (IOSCO). ACOs need to have a bachelor's degree in finance, public policy, or business administration. They must also pass two written exams as well as one oral exam.

The National Association of State Boards of Accountancy offers the certification of Certified Fraud Examiners (CFE). Candidates must pass at least three exams to be certified fraud examiners (CFE).

International Federation of Accountants has granted accreditation to a Certified Internal Audior (CIA). The International Federation of Accountants (IFAC) requires that candidates pass four exams. These include topics such as auditing and risk assessment, fraud prevention or ethics, as well as compliance.

American Academy of Forensic Sciences (AAFS) designates an Associate in Forensic Account (AFE). AFEs must have graduated from an accredited college or university with a bachelor's degree in any field of study other than accounting.

What does an auditor do? Auditors are professionals who inspect financial reporting controls and audit the internal controls. Audits can be conducted randomly or based upon complaints from regulators regarding the organization's financial reports.