Double entry accounting refers to a system in which a company's transactions are recorded in two ways - debits and credits. Both the traditional approach and the accounting equation approach take into account two aspects of transactions - the real account debits and personal account credits. In the same way, debits and credits are recorded in different books. These are the basic concepts of double-entry accounting. These are the main concepts of double entry accounting.

Credits and debits

Double entry accounting is used to record debits and credits. The main categories of double entry are the credit and the debit. Using this system, debits are posted to the left column of an account and credits are posted to the right column. The debit is always larger than the credit. Credits are generally higher than debits. The amount of the credit is then equal to the debit. The account balance will be equal if the credit and debit are equal.

Daybooks

Daybooks are essential documents in double-entry systems of accounting. Each transaction is recorded in at most two ledger accounts. A debit goes to the customer ledger, while a charge is transferred to the general leadger account. Daybooks are useful for businesses to keep track of their finances. Daybooks, however, are not meant to replace a nominal leger. Before you make the switch to double-entry, it is important that your company considers its needs and objectives.

Nominal ledger

Transactions conducted by a business are recorded under the account name as well as the date. There may be different journals that a business keeps for different purposes. One example is a special journal for cash transactions. These journals keep track of specific transactions and are usually not included in the general journal. The nominal ledger then summarises these special journal accounts. This document records all transactions occurring during the period.

Balance sheet

A double entry balance sheet contains three components: assets, liabilities, and equity. Assets are the items owned by a business, such as cash, machinery, and buildings. Liabilities represent what the business owes third parties. Equity refers the owners' equity in the company, which can include their contributions or share of profits. Understanding how each component of the balance sheet impacts the other is crucial when using this accounting system.

The generally accepted accounting principles

The principle of double-entry bookkeeping is an important concept in financial accounting. It ensures that assets, liabilities and the total of these two numbers are equal. Double-entry bookkeeping is a very popular method that banks and investors prefer. Double-entry is also flexible, allowing for personalized adjustments. The basic principles of double-entry bookkeeping are as follows.

FAQ

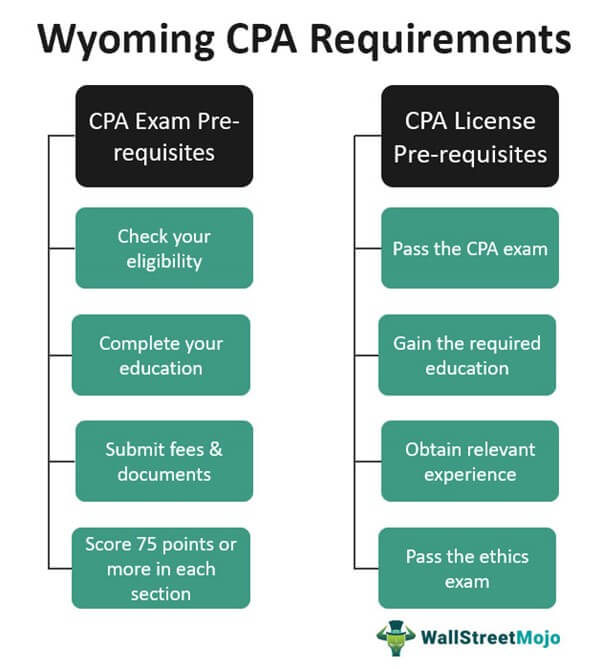

What is Certified Public Accountant?

Certified public accountant (C.P.A.). is a person with specialized knowledge in accounting. He/she knows how to prepare tax returns and assist businesses in making sound business decisions.

He/She keeps an eye on the company's cash flow, and ensures that everything runs smoothly.

Why Is Accounting Useful for Small Business Owners?

The most important thing you need to know about accounting is that it's not just for big businesses. It is useful for small-business owners as it helps them track all the money that they spend and make.

You probably know how much money your business is making each month if you are a small-business owner. What happens if an accountant isn't available to you? You may be wondering where your money is being spent. You might forget to pay your bills on time which could negatively impact your credit rating.

Accounting software makes it simple to track your finances. There are many types of accounting software. Some are completely free, while others can cost hundreds of thousands of dollars.

However, regardless of the type of accounting software you choose, you will need to be familiar with its basics. By doing this, you will not waste time learning how to operate it.

These are three basic tasks that you need to master:

-

Input transactions into the accounting software.

-

Keep track of your income and expenses.

-

Prepare reports.

Once you've mastered these three things, you're ready to start using your new accounting system.

What should I look for in an accountant's hiring decision?

Ask about their qualifications, experience, and references when interviewing an accountant.

It is important to find someone who has done this before, and who knows what he/she's doing.

Ask them if you could benefit from their special skills and knowledge.

Be sure to establish a good reputation within the community.

How can I find out if my business needs an accountant

Many companies hire accountants when they reach certain size levels. One example is a company that has annual sales of $10 million or more.

However, some companies hire accountants regardless of their size. These include small companies, sole proprietorships as well partnerships and corporations.

A company's size doesn't matter. It doesn't matter how big a company is.

If it does then the company requires an accountant. Otherwise, it doesn't.

Statistics

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

The Best Way To Do Accounting

Accounting refers to a series of processes and procedures that enable businesses to accurately track and record transactions. It includes recording income, expense, keeping records sales revenue and expenditures as well as creating financial statements and analyzing data.

It also involves reporting financial results to stakeholders such as shareholders, lenders, investors, customers, etc.

There are many ways to do accounting. There are several ways to do accounting.

-

Create spreadsheets manually

-

Using software like Excel.

-

Handwriting notes on paper

-

Use computerized accounting systems.

-

Online accounting services.

There are many ways to do accounting. Each method has both advantages and disadvantages. The type of business you have and the needs of your company will determine which method you choose. You should always consider the pros and cons before choosing any method.

Accounting can not only be more efficient, but there may also be other reasons to use it. Good books can prove your work if you are self-employed. Simple accounting may be best for small businesses that don't have a lot of money. However, complex accounting may be more appropriate for businesses that generate large amounts of cash.